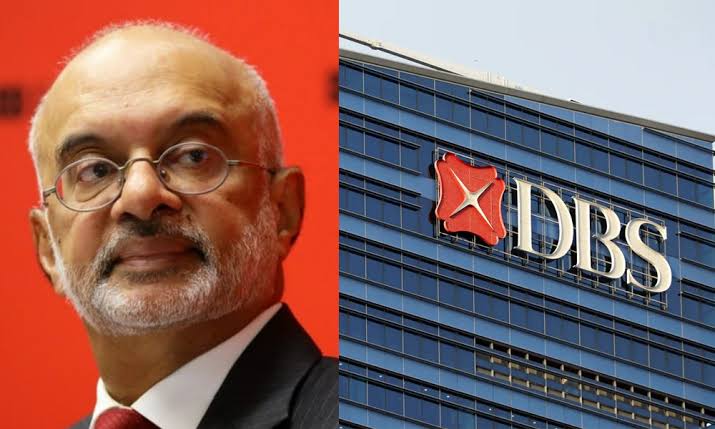

Singapore — Southeast Asia’s largest bank, DBS, announced plans Monday to cut 4,000 jobs over three years as artificial intelligence (AI) takes over tasks traditionally done by humans. The move, one of the first detailed accounts of AI’s impact on banking jobs, comes as global financial institutions grapple with automation’s disruptive potential.

Contents

Singapore’s DBS Bank is set to cut 4,000 roles by 2028 as AI handles more tasks, marking a pivotal moment in banking’s automation journey. But will this reshape the industry—or widen inequality? Here’s what you need to know.

Key Takeaways:

- 4,000 roles cut via natural attrition (temporary/contract staff).

- 1,000 AI-related jobs created.

- DBS deploys 800 AI models across 350 use cases, expecting a $745 million economic impact in 2025.

- IMF warns AI could affect 40% of global jobs and worsen inequality.

DBS’s AI Journey

DBS CEO Piyush Gupta, stepping down in March, revealed the bank has used AI for over a decade. Its 800 AI models power tasks from fraud detection to customer service, generating $745 million in projected economic value in 2025.

Industry Trends

- AI in Banking: JPMorgan, HSBC, and others are testing AI for trading, lending, and compliance.

- Job Displacement: IMF predicts AI could impact 40% of jobs worldwide, with banking particularly vulnerable.

- Regulatory Scrutiny: Global regulators are drafting AI guidelines to balance innovation and risk.

DBS’s AI Strategy: Efficiency vs. Employment

- Job Cuts: 4,000 roles (10% of workforce) cut via attrition; permanent staff spared.

- New Roles: 1,000 AI/tech jobs added, focusing on data science and automation.

- Economic Impact: AI models drive $745 million in value, but critics warn of inequality.

Expert Insights

- IMF Managing Director Kristalina Georgieva: “AI will likely worsen inequality unless policies address displacement.”

- DBS CEO Piyush Gupta: “AI is a tool to augment, not replace, humans.”

- Data-Driven Breakdown

- DBS Workforce: 41,000 total employees (8,000–9,000 temporary/contract).

- AI Adoption: 800 AI models across 350 use cases (e.g., chatbots, risk assessment).

- Global Banking AI: 72% of banks plan to increase AI spending in 2025 (McKinsey).

DBS projects $745 million economic value from AI in 2025. | DBS Bank AI layoffs

- Future Outlook

- Industry Shifts: Banks may follow DBS’s lead, prioritizing AI over human labor.

- Expert Predictions:

- Bank of England Governor Andrew Bailey: “AI won’t be a mass job destroyer—workers will adapt.”

- IMF: Urges governments to fund retraining programs for displaced workers.

Conclusion

DBS’s AI-driven job cuts signal banking’s future: efficiency gains paired with workforce disruption. While 1,000 new tech roles offer hope, the IMF’s inequality warning looms. What’s your take—will AI save or sink banking jobs? Share your thoughts below.

Final Thought:

As AI transforms industries, will society prioritize profit over people? The answer could define our economic future