Overview of Kensho

Kensho is a leading financial analytics and data analysis platform that harnesses the power of artificial intelligence (AI) to help financial professionals make data-driven decisions. As an AI-powered tool, Kensho integrates machine learning algorithms with vast financial datasets to provide real-time market insights, predictive analytics, and advanced financial modeling capabilities. By processing complex data, Kensho enables users to gain actionable insights, forecast market trends, and manage financial risks more effectively.

With its advanced AI technology, Kensho assists in various aspects of financial decision-making, making it an indispensable tool for investment banks, asset managers, financial analysts, and other key players in the finance industry.

Key Features of Kensho

Kensho offers a comprehensive suite of features that cater to the needs of financial professionals:

- Real-Time Market Insights: Kensho uses AI to process large amounts of financial data from multiple sources and provide up-to-the-minute insights into market trends, news, and events. This helps users stay ahead of market movements and make informed decisions quickly.

- Financial Modeling: The platform offers powerful tools for financial modeling, allowing analysts to create detailed models based on current and historical data. These models help in forecasting market behaviors, assessing investment opportunities, and predicting future performance.

- Automated Reporting: Kensho automates financial reporting by generating real-time, customizable reports. This reduces the time spent on manual data analysis and ensures reports are consistently accurate and up-to-date.

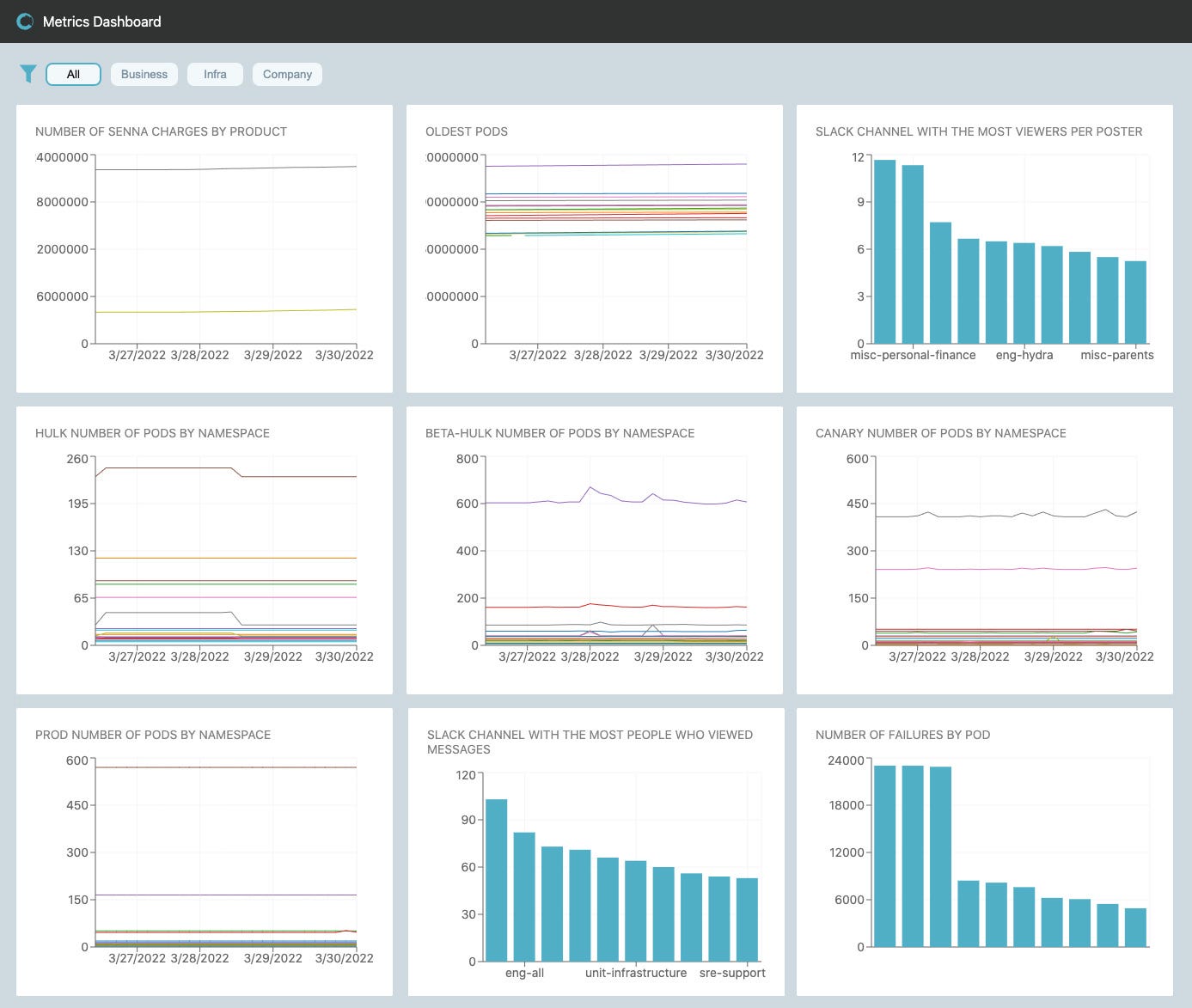

- Data Visualization Tools: Kensho’s intuitive dashboard and data visualization tools allow users to present complex financial data in an easily understandable format. These visualizations help highlight key trends and insights for better decision-making.

Use Cases and Applications

Kensho is widely used in the financial industry for a variety of purposes:

- Market Intelligence: Investment banks and asset managers rely on Kensho for in-depth market analysis, identifying potential investment opportunities and assessing risks. The platform’s AI-driven insights allow them to stay ahead of the competition.

- Risk Management: Kensho’s predictive analytics capabilities are crucial for managing financial risks. By forecasting potential market fluctuations, it helps businesses mitigate risks and develop strategies for market volatility.

- Forecasting: Kensho’s AI-driven models are used to predict future market trends, providing asset managers and financial analysts with the foresight to make strategic investment decisions.

Benefits of Using Kensho

Kensho offers several advantages for finance professionals:

- Improved Decision-Making: With access to real-time data and predictive insights, users can make informed decisions faster and with greater confidence.

- Enhanced Predictive Analytics: Kensho’s AI algorithms excel at analyzing complex datasets, providing more accurate predictions about market movements, investment opportunities, and risks.

- Operational Efficiency: By automating reporting and financial modeling, Kensho reduces manual tasks, allowing users to focus on higher-value work and strategic decision-making.

- Scalability: Kensho is designed to scale with businesses as they grow, offering flexible solutions for firms of all sizes.

Ease of Use

Kensho is designed with usability in mind. Its intuitive interface and easy-to-navigate dashboard make it accessible to both technical and non-technical users. Setting up the platform is straightforward, and users can quickly integrate it into their existing workflows. Kensho also offers robust customer support to assist with any technical issues or questions.

Pricing Structure

Kensho offers a subscription-based pricing model, with plans tailored to the needs of different financial institutions. Pricing details are generally customized based on the size of the firm and the features required. While the platform’s pricing may be on the higher end compared to some other financial tools, its comprehensive features and AI capabilities justify the cost for businesses that rely heavily on data analysis and predictive modeling.

Customer Experience

Many users have praised Kensho for its powerful insights and ease of use. Financial analysts and portfolio managers report that the tool has significantly improved their ability to make faster, more accurate decisions. Kensho has been particularly valuable for investment banks and asset management firms, streamlining complex workflows and reducing the time spent on manual data analysis.

For instance, one asset manager noted that Kensho’s predictive analytics helped them identify investment opportunities that they would have otherwise missed. Another user mentioned that Kensho’s real-time market insights allowed them to make quicker decisions during volatile market conditions, enhancing their portfolio’s performance.

Competitors

While Kensho is a leading AI tool for financial analytics, it competes with several other platforms in the market. Some notable competitors include:

- AlphaSense: AlphaSense also provides AI-driven financial analytics, focusing on real-time insights from financial documents and market news. However, Kensho stands out with its more advanced financial modeling and predictive capabilities.

- Zest AI: Zest AI focuses more on credit risk modeling, whereas Kensho offers a broader range of financial data analysis, including forecasting and market intelligence.

Kensho’s ability to integrate multiple sources of financial data and provide comprehensive insights across various domains of finance gives it a competitive edge over some of its competitors.

Pros and Cons

Pros:

- Powerful AI-driven insights and predictive analytics

- Real-time market insights to stay ahead of market trends

- Automated reporting and customizable financial models

- User-friendly interface, even for non-technical users

- Scalable for businesses of all sizes

Cons:

- Pricing may be a concern for small firms or individual users

- Limited transparency on the exact pricing structure, which can make it difficult to evaluate costs upfront

- As with any AI tool, there is a learning curve in understanding the full potential of the platform

Conclusion

Kensho is an advanced AI-powered financial analytics tool that can significantly enhance decision-making, improve operational efficiency, and provide deep insights into market trends. Its robust features, including real-time market analysis, financial modeling, and predictive analytics, make it an indispensable tool for investment banks, asset managers, and financial analysts. While its pricing may be a consideration for smaller firms, its value proposition is clear for larger institutions that rely on data-driven strategies.

If you’re looking for a powerful AI tool to enhance your financial analytics and decision-making, Kensho is a top choice. Learn more about Kensho and explore how it can transform your financial operations by visiting their website or requesting a demo today.

Call to Action:

Want to see Kensho in action? Access the Free Trial today and discover how this powerful AI tool can help your business gain a competitive edge in the world of finance.