In the fast-paced world of finance, the ability to access timely and relevant market data is crucial for making informed decisions. This is where AlphaSense, a powerful market intelligence and financial research platform, comes into play. Using advanced AI, natural language processing (NLP), and cutting-edge analytics, AlphaSense is transforming how finance professionals, analysts, and investors gain insights into the financial landscape.

In this review, we’ll explore the platform’s key features, benefits, use cases, pros and cons, pricing information, and customer reviews to help you decide if AlphaSense is the right tool for your financial research needs.

What is AlphaSense?

AlphaSense is an AI-powered platform designed to streamline financial research and market intelligence. It utilizes natural language processing (NLP) and machine learning algorithms to help users analyze vast amounts of financial documents, including earnings calls, SEC filings, press releases, and news articles. The platform is designed to extract valuable insights, detect trends, and provide actionable data to aid decision-making for professionals in fields like investment banking, asset management, and corporate finance.

Key Features of AlphaSense

- Natural Language Processing (NLP) for Financial Document Analysis

- AlphaSense leverages NLP to sift through and analyze thousands of financial documents in real time. By understanding the nuances of financial terminology, the platform can extract key data points, helping users to quickly assess a company’s performance, forecast trends, and stay ahead of market changes.

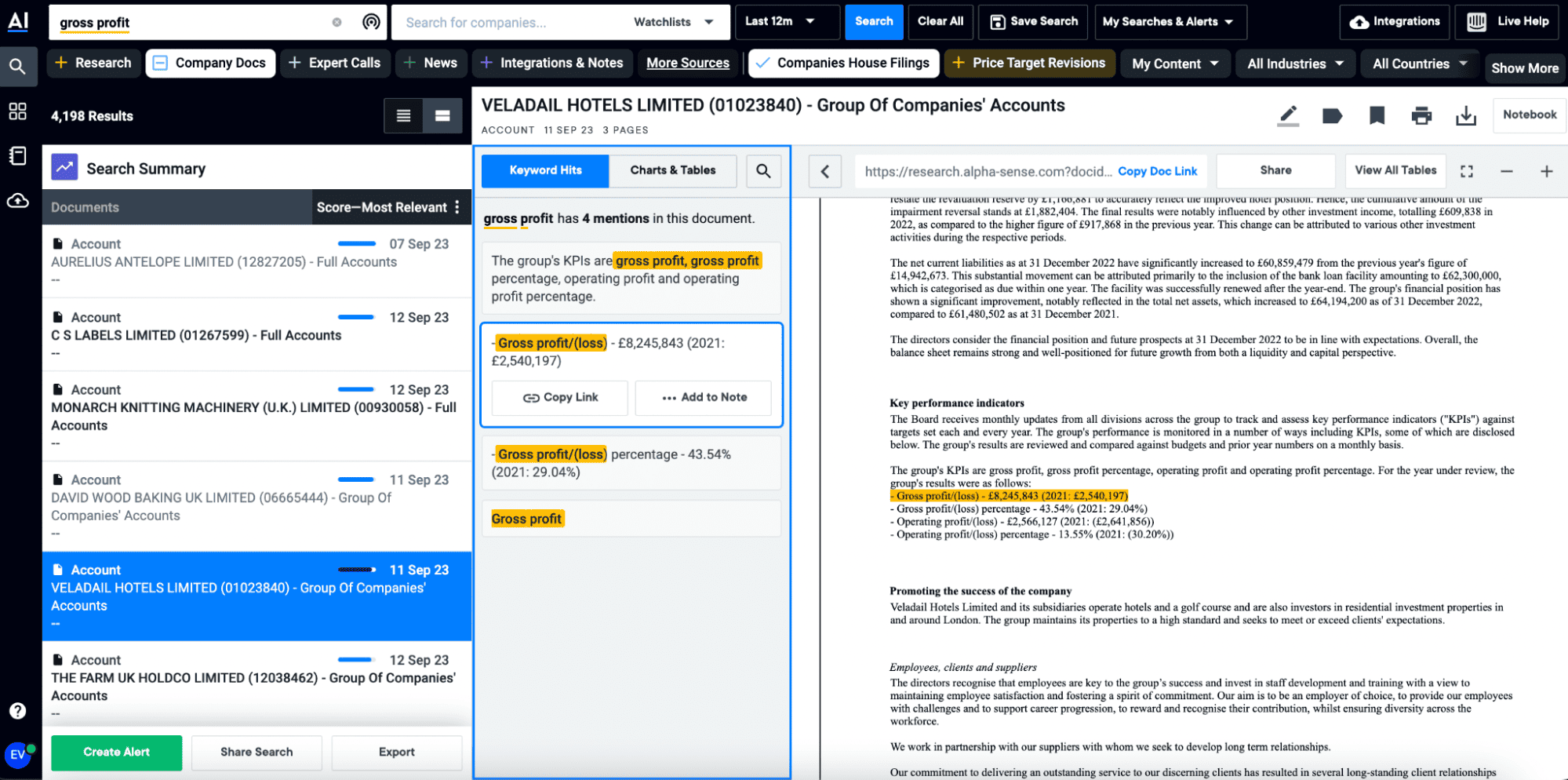

- Advanced Search Functionality

- The search capabilities of AlphaSense are one of its standout features. Users can search across a vast library of financial documents and refine results based on specific keywords, topics, or even sentiments. This allows for deeper insights and quicker access to critical information when analyzing companies or industries.

- Real-Time Market Data and Alerts

- AlphaSense delivers real-time market data, allowing users to track stock performance, industry trends, and market shifts. Alerts can be set up to notify users when specific events or documents are released, ensuring that critical information never goes unnoticed.

- AI-Powered Sentiment Analysis and Trend Forecasting

- The platform uses AI-driven sentiment analysis to determine how the market views certain companies or sectors. It analyzes the tone and context of earnings calls, news, and reports, providing users with a comprehensive understanding of how sentiments might impact stock prices or market conditions. AlphaSense also leverages AI for trend forecasting, helping professionals anticipate market movements based on historical data and patterns.

- Integration with Financial Tools and Platforms

- AlphaSense integrates seamlessly with other financial tools and platforms, enhancing its value for users who already rely on software like Bloomberg Terminal, FactSet, and Excel. These integrations allow for smooth data import/export and collaboration across different systems.

Benefits of Using AlphaSense

- Streamlined Financial Research: AlphaSense automates much of the financial research process, saving analysts countless hours spent searching through documents. With its advanced search and AI-powered features, it enables users to identify key insights without wading through irrelevant data.

- Improved Decision-Making: By providing real-time data, trend analysis, and sentiment insights, AlphaSense equips finance professionals to make better-informed decisions. Whether you’re tracking earnings reports or forecasting market trends, AlphaSense empowers you to act quickly and confidently.

- Enhanced Market Forecasting: With access to vast datasets, trend analysis, and AI-powered forecasting tools, AlphaSense helps users predict market movements, enabling proactive decision-making in both stable and volatile market conditions.

- Customization and Efficiency: The ability to customize alerts, search parameters, and data filters allows professionals to tailor the platform to their specific needs. This means users can quickly focus on the most relevant information, improving overall productivity.

Use Cases of AlphaSense

- Investment Banking

- Investment bankers rely heavily on accurate, up-to-date information. AlphaSense helps them analyze earnings calls, industry reports, and market shifts, offering deep insights into potential mergers, acquisitions, or IPOs.

- Asset Management

- Asset managers use AlphaSense to assess market trends, track portfolio performance, and identify new investment opportunities. The AI-driven sentiment analysis and trend forecasting capabilities are invaluable for making data-driven investment decisions.

- Corporate Finance

- Corporate finance teams utilize AlphaSense for competitive analysis, risk management, and strategic decision-making. The platform helps them stay ahead of market developments, ensuring they remain competitive in a rapidly changing environment.

Pros and Cons of AlphaSense

Pros:

- Comprehensive Document Coverage: AlphaSense has access to a wide range of financial documents, including earnings calls, news articles, and SEC filings. This ensures that users can analyze every angle of a company’s performance.

- Intuitive Interface: The platform’s interface is user-friendly, making it easy for professionals with varying levels of tech expertise to navigate and extract valuable insights.

- Real-Time Alerts: AlphaSense’s real-time alerts allow users to stay on top of market movements, helping them react quickly to new developments.

- AI-Powered Insights: With AI tools for sentiment analysis and forecasting, AlphaSense provides a deeper understanding of market trends than traditional research methods.

Cons:

- Pricing: AlphaSense’s pricing model may be a barrier for smaller firms or individual investors, as it is more suited to large institutions with significant research budgets.

- Learning Curve: While the platform is intuitive, some users may need time to familiarize themselves with the advanced features, especially the NLP-driven search and sentiment analysis tools.

- Not Fully Customizable: Some users may find the platform’s customization options limited, particularly when compared to competitors like Kensho, which offers more flexible data integration.

Pricing Information

AlphaSense offers a subscription-based pricing model, with various tier options designed for different types of users. The exact pricing depends on the level of access and the specific features required, and pricing details are typically available upon request through the AlphaSense sales team. While it’s not the most affordable option for smaller organizations, its powerful features justify the investment for large firms with extensive research needs.

Customer Reviews

AlphaSense has received positive feedback from finance professionals and organizations. Many users praise the platform for its ability to uncover insights quickly and its advanced search functionality. John Doe, a senior investment analyst, states, “AlphaSense has revolutionized the way we conduct market research. It’s easy to use, and the AI-driven insights have saved us countless hours.”

However, some users note that the platform could benefit from additional customization options, particularly for those with highly specific research needs.

Conclusion

AlphaSense is an exceptional market intelligence tool that leverages AI and NLP to streamline financial research, enhance decision-making, and provide real-time insights. While its pricing may be a consideration for smaller businesses, its robust features and powerful analytics make it an invaluable asset for large financial institutions and professionals in investment banking, asset management, and corporate finance. If you’re looking for a comprehensive, AI-powered financial research tool, AlphaSense is definitely worth considering.

Call to Action:

Want to see AlphaSense in action? Access the Free Trial today and discover how this powerful AI tool can help your business gain a competitive edge in the world of finance.