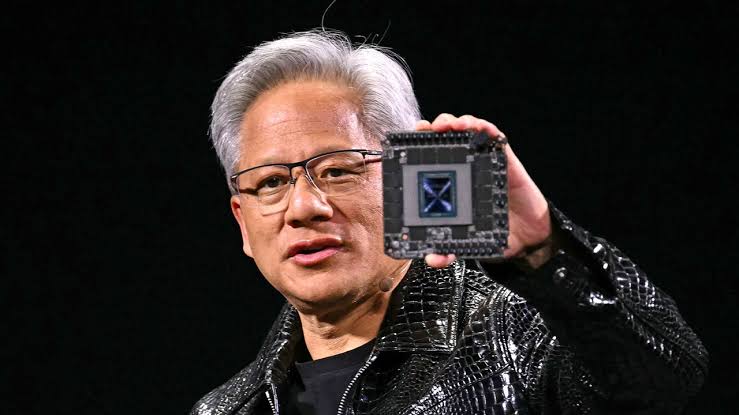

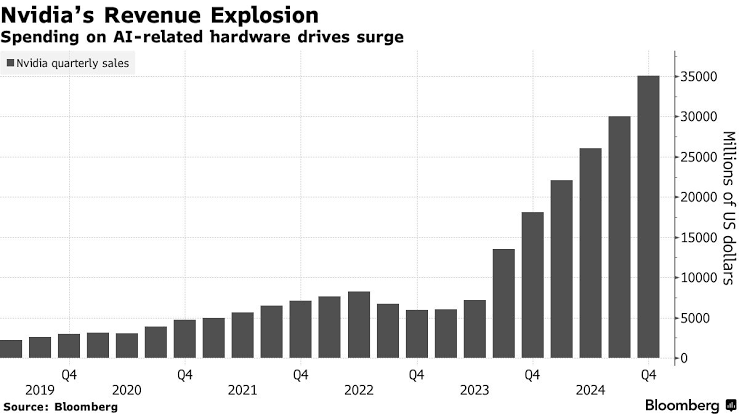

London — Nvidia, the chipmaker powering the AI boom, reported blockbuster sales of $39 billion (up 74% YoY) despite fears sparked by Chinese rival DeepSeek’s claim to use cheaper chips. CEO Jensen Huang shrugged off concerns, stating demand for advanced AI hardware remains robust as Meta and Microsoft reaffirm their reliance on Nvidia’s technology.

Contenido

Nvidia’s AI chip sales hit $39 billion in Q4, a 74% surge, as demand from Meta, Microsoft, and others offset fears of a “bubble” sparked by Chinese startup DeepSeek. The firm’s shares, which plunged 10% after DeepSeek’s launch, rebounded after Huang emphasized the irreplaceable role of advanced chips in AI. Here’s how Nvidia is cementing its dominance.

Principales conclusiones:

- $39B Revenue: 74% YoY growth driven by AI data centers.

- DeepSeek Backlash: Claims of low-cost chips caused brief market panic.

- Meta/Microsoft Support: Big tech reaffirms reliance on Nvidia.

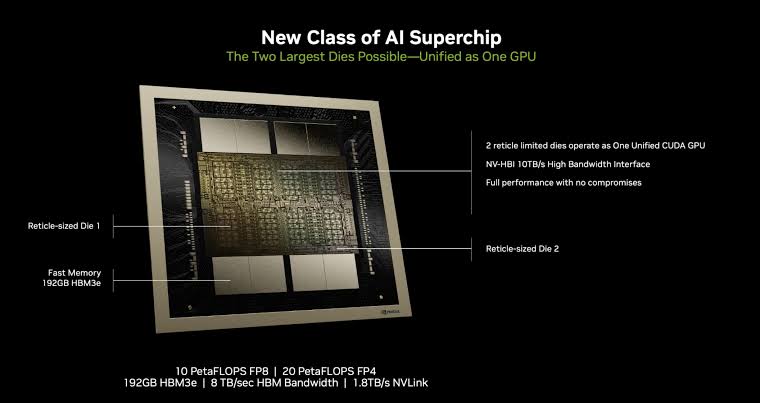

- Blackwell Chips: New architecture boosts performance 3x over rivals.

Context & Background

AI Boom Fuels Nvidia’s Rise

- Market Value: $3 trillion, up 400% in two years.

- AI Demand: Chips handle 80% of AI training workloads.

- DeepSeek’s Challenge: Trained chatbot on “less advanced” chips, sparking bubble fears.

Regulatory Headwinds

- US Export Controls: Bloque de Nvidia de envío de nivel superior que fichas a China.

- China Demand: Sigue siendo plana; los envíos se espera que se mantenga en los niveles actuales.

Main Analysis

Nvidia’s Financial Powerhouse

- Q4 Sales: $39 billion, beating estimates by $3B.

- AI Data Centers: 60% of revenue; strongest in the US.

- Blackwell Chips: New architecture drives 3x faster training than rivals.

DeepSeek’s Short-Lived Impact

- Sell-Off: Nvidia shares fell 10% post-DeepSeek launch.

- Recovery: Meta, Microsoft confirmed ongoing investment in Nvidia.

- Huang’s Response: “AI requires specialized chips—DeepSeek’s approach won’t scale.”

Opiniones de expertos

- Jensen Huang: “Software is now machine learning, not hand-coding.”

- Collette Kress (CFO): “Global demand is growing, especially in Europe.”

Visual: Nvidia’s Revenue Growth

Perspectivas De Futuro

- AI Dominance: Analysts predict Nvidia will retain 70%+ market share.

- China Strategy: Focus on non-restricted chips and partnerships.

- Rival Risks: AMD and Intel may struggle to match Blackwell’s performance.

Expert Predictions

- Tech Analyst Dan Ives: “Nvidia’s moat is widening—DeepSeek is a footnote.”

- DeepSeek CEO: “We’re targeting niche markets, not direct competition.”

Conclusión

Nvidia T4 resultados de demostrar su AI chip de dominio se encuentra intacta, a pesar de DeepSeek fugaces de la interrupción. Como Meta, Microsoft, y otras de doble hacia abajo sobre la IA, Huang apuesta en hardware especializado paga. Pero puede Nvidia sostener su $3tn valoración como rivales en la carrera para ponerse al día? Comparta sus ideas a continuación.

Final Thought:

In the AI arms race, will advanced chips remain king—or will cost-cutting upend the market?